Why Choosing an Insurance-Approved Body Shop Matters

Who is Responsible for Collision Repair Costs After an Accident?

Ever wondered if your car is a total loss after an accident? Or can it just be fixed? This question is common for car owners. Knowing what insurers look at can really help.

We’ll look at what makes a car a total loss or if it can be fixed. We’ll also talk about how this affects the insurance money you might get. Being in the know can help you feel more sure about your choices.

Key Takeaways

- Understanding whether your car qualifies as a total loss is crucial.

- Insurers evaluate repair estimates to determine the best course of action.

- A total loss can impact future insurance payouts.

- Knowing the repair costs compared to vehicle value is essential.

- Being informed helps us make confident decisions after an accident.

Understanding Total Loss vs. Repair: The Basics

When our cars get damaged, we hear about *total loss* and *repair*. Knowing these terms helps us understand insurance better. A total loss happens when fixing the car costs more than it’s worth. On the other hand, repair means making the car good as new again.

Definition of Total Loss

A total loss is when fixing the car is too expensive. Insurers look at the damage and decide if it’s cheaper to replace the car. If so, they might pay for the car’s value instead of fixing it.

Definition of Repair

Repair means fixing the car to how it was before. This includes bodywork and engine fixes. Knowing this helps us decide what to do after an accident.

Importance of Understanding the Difference

Knowing the difference between total loss and repair is key. It helps us make smart choices and avoid surprises. It guides us through tough times and helps us decide what’s best for our cars.

How Insurers Evaluate Vehicle Damage

When an accident happens, it’s important to know how insurance companies check vehicle damage. They use special methods to see how much damage there is. They figure out if the car can be fixed or if it’s a total loss.

Damage Assessment Techniques

Insurance companies use many damage evaluation techniques to check cars. They first look at the car to see if there’s any damage. Then, they use computers to figure out how much it will cost to fix it.

This way, they make sure they get it right. They want to make sure everyone gets a fair deal.

Role of Adjusters in the Process

Insurance adjusters are key in checking vehicle damage. They talk to the people who own the car and get all the details. They look at the damage and decide if it needs to be fixed or if it’s too bad.

They know a lot about cars and how much they’re worth. This helps everyone understand what will happen next. It makes the claims process clearer.

Factors Influencing Total Loss Determination

Knowing what makes a car a total loss is key. It’s not just one thing. We look at market value, repair costs, and salvage value.

Vehicle Market Value

The market value is the price of similar cars. It helps decide if fixing the car is worth it. If fixing costs more than the car’s value, it might be a total loss.

Repair Costs vs. Vehicle Value

Then, we compare repair costs to the car’s value. Insurers check if fixing the car is smart. If fixing costs too much, it might be a total loss. Knowing the car’s value helps avoid surprises.

Salvage Value Considerations

Lastly, we think about salvage value. This is what the insurance can get by selling parts. If the salvage value is high, it might change the decision. Knowing this helps us understand our situation better.

Common Scenarios for Total Loss Decisions

Many situations lead to a total loss decision. These include car crashes, natural disasters, and theft or vandalism. Each case has its own reasons for being declared a total loss.

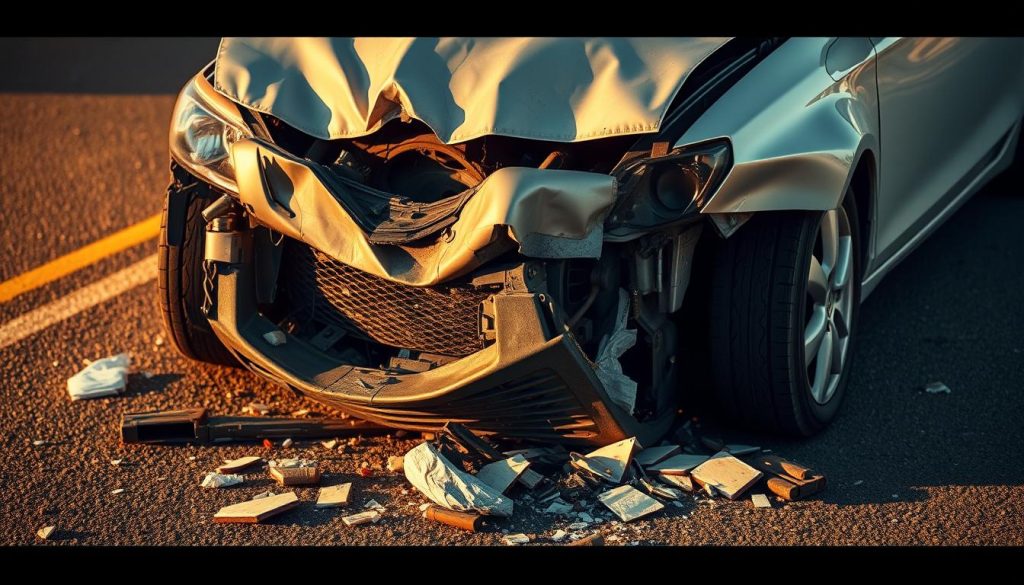

Collision Damage

Car crashes are the main reason for total loss decisions. Accidents can badly damage a car’s structure. If fixing it costs more than the car is worth, it’s often declared a total loss.

This affects our safety on the road and what we choose to buy next.

Natural Disasters

Natural disasters like hurricanes or floods can also cause total losses. These events can damage cars beyond repair. Insurers then decide if the car is a total loss based on its condition.

Theft or Vandalism

Car theft and vandalism are also reasons for total loss decisions. If a car is stolen and not found, or if it’s badly damaged by vandalism, it might be declared a total loss. Insurers look at the damage and repair costs to make their decision.

The Total Loss Threshold Explained

Understanding vehicle insurance is key. Knowing the total loss threshold is important. It changes from state to state. It helps decide if a car is a total loss.

This threshold is a percentage of the car’s current value. It’s crucial for insurance claims.

Percentage-Based Thresholds

These thresholds show when repair costs are more than the car’s value. The percentages vary by state. Some states say 70%, others 80% or less.

Knowing these numbers is important. They affect our claims and the insurance process a lot.

State Variations in Total Loss Rules

State laws also play a big role. They can make things tricky. For example, some states use the car’s purchase price. Others look at how much the car has depreciated.

Staying informed can help avoid surprises. It’s good to know these rules before a claim.

Repair Vs. Replacement: What’s Your Best Option?

Choosing between repair or replacement for a damaged car is big. We need to think about money and how we feel about it. Making a smart choice is important.

Financial Implications

Money matters a lot when deciding. We should look at repair costs and what the insurance might pay if we choose to replace it. Sometimes, fixing the car might cost more than what the insurance offers. We need to check these numbers to fit our budget.

Time Considerations

How long it takes to fix the car or find a new one is key. Fixing it might take a lot of time, making us wait. Getting a new car could take even longer, with more research and waiting for dealers. We must think about these times and what we need now.

Emotional Factors

Our feelings about our car are also important. We often get attached to our cars, making the choice hard. It’s important to think about these feelings when deciding what to do with our car.

Benefits of Choosing Repair

When we decide to fix our car or claim it as a total loss, we should think about the good sides. Fixing our car can save money and make us feel better. It’s a smart choice for many reasons.

Retaining Vehicle Sentimentality

Our cars often hold special memories for us. It might be our first car or a family favorite. Fixing it keeps those memories alive.

Potential Cost Savings

Fixing our car can also save us money. Repair costs are usually less than what insurance pays for a total loss. This helps us keep more money in our pockets.

Extended Vehicle Life

Fixing our car also makes it last longer. With regular care and quick fixes, our car can go on for years. It’s a smart choice for the future.

Risks Associated with Total Loss

When a car is declared a total loss, we face many challenges. These can greatly affect our car ownership experience. It’s important to understand these risks to make good decisions.

Lowered Insurance Premiums

One big worry is that insurance rates might go down. Insurance companies see these cars as riskier. This could mean higher costs for us in the future.

Loss of Warranty Coverage

A total loss can also mean no warranty. Cars declared total losses might not get warranty protection. This means we could have to pay for repairs ourselves, adding to our costs.

Future Resale Value Issues

Another big risk is the car’s resale value. Cars with salvage titles sell for less. This can hurt us financially when we sell or trade in our car.

How to Prepare for a Total Loss Claim

Getting ready for a total loss claim is easier if we know what to do. We need to have all the right documents and understand our insurance policy. This helps us make a strong case to the insurer and get the best compensation.

Gathering Required Documents

First, we must collect all important papers. These include:

- Accident reports detailing the incident

- Repair estimates that highlight vehicle damage

- Title of the vehicle to establish ownership

- Photos of the vehicle before and after the accident

Having these ready makes the claims process smoother and helps talk to the insurer.

Understanding Your Policy Details

It’s also key to know our policy well. We should look at:

- Coverage limits that apply to our vehicle

- Deductible amounts that may be deducted from our claim

- Any applicable exclusions or conditions that could impact our claim

Understanding these can make our claims process better. It helps us fight for what we deserve.

Working with Insurance Adjusters

When we deal with claims after a car accident, how we work with adjusters matters a lot. It’s key to know how to talk to insurers. Good communication helps us understand each other better, leading to fair deals and quick fixes.

Effective Communication Tips

To talk better with insurers, try these tips:

- Be Clear and Concise: Share all important details about the accident without extra stuff.

- Document Everything: Keep good records of talks, emails, and any papers you share.

- Stay Professional: Keep a polite tone to help talks go smoothly.

- Ask Questions: If you’re not sure about something, ask. It shows you care.

Rights and Responsibilities

Knowing our rights as policyholders is as important as knowing what adjusters do. We have the right to:

- Get a fair claim review based on correct info.

- Know about the claim process and when we’ll hear back.

- Disagree with insurer decisions the right way.

When working with adjusters, knowing our and their roles helps the process go smoother. We should stay informed and active, making sure our rights are respected.

What to Do If Your Car Is Declared a Total Loss

Getting a total loss declaration for our car can feel scary. Knowing what to do next makes things easier. This is a key time to talk clearly and plan well to get a good deal.

Next Steps After Declaration

After we hear our car is a total loss, we need to do a few things:

- Review the insurance policy – Knowing our policy helps us guess what the insurer will do.

- Document the vehicle condition – Taking pictures and keeping records helps our case.

- Request a detailed report – Asking the insurer to explain how they value our car is important.

- Understand the payout process – Learning about the timeline and what to expect helps avoid surprises.

- Consult a professional if necessary – Getting advice from experts can help us get more from our claim.

Negotiating with Insurers

Talking to insurers can be tough. We must be ready to stand up for ourselves:

- Know the market value – Looking up similar cars helps us negotiate better.

- Maintain clear communication – Keeping track of all talks with the insurer is important.

- Be persistent – If the first offer is not good, we should ask for a second look.

- Consider getting independent appraisals – A fair outside look might show the insurer’s value is wrong.

- Stay calm and professional – Keeping a cool head helps us talk better.

Conclusion: Making the Right Choice

When we talk about total loss versus repair, it’s important to think carefully. We need to look at the money side and how we feel about our cars. Every case is different, and knowing the details helps us make a better choice.

Getting help from experts like Miracle Body and Paint is a good idea. They know a lot about insurance and car values. Their advice can help us choose wisely, which is good for our happiness and money.

To end, we should learn everything we can about total loss and repair. This way, we can make choices that fit our lives. Let’s make our decision with confidence, using the help of experts to guide us.