What to Expect: How Long Collision Repairs Take

How to Prevent Rust After Collision Repair

When your car is in the shop, knowing about car rental insurance is key. We might need a temporary car, and knowing if our insurance covers it is important. By checking our insurance, we can keep our daily life going without a hitch.

In this article, we’ll look into how to find the right temporary car solution. We’ll explore the options that make getting around easy while our cars are fixed.

Key Takeaways

- Understanding car rental insurance coverage is essential to remain mobile during repairs.

- Rental reimbursement can alleviate the costs associated with temporary transportation.

- We should always review our insurance policies for rental car options.

- Awareness of different coverage types can enhance our experience during repairs.

- Checking for rental coverage before an incident can save time and stress.

Understanding Car Rental Insurance Coverage

Car rental insurance helps us deal with unexpected car troubles. It’s key for those whose cars are in the shop. With it, we can rent a car without spending too much money.

What is Car Rental Insurance?

Car rental insurance protects us when we rent a car. It helps when our own car is being fixed. This insurance usually covers accidents, so we’re not stuck without a car.

Why is Car Rental Insurance Important?

Car rental insurance is important because it saves us money when our car is down. We use our cars every day. So, if it breaks, we need a way to get around.

With car rental insurance, we can get a car without worrying about the cost. Knowing about rental reimbursement helps us choose the right insurance.

Types of Insurance Coverage for Rental Cars

When we rent a car, it’s key to know about insurance options. Learning about these can make us feel safer while driving. The main types are collision, comprehensive, and liability coverage.

Collision Coverage

Collision coverage helps if we crash the rental car. It covers damages from accidents with other cars or objects. If we worry about accidents, this coverage is very important.

Comprehensive Coverage

Comprehensive coverage protects against more than just crashes. It covers theft, vandalism, and damage from natural disasters. If we rent in areas with bad weather or theft, this is a good choice.

Liability Coverage

Liability coverage is key if we cause an accident. It pays for injuries or damage we cause to others. Safe driving is important, but this coverage keeps us safe financially.

When is Rental Car Coverage Applicable?

Knowing when you need rental car coverage is key. It saves time and stress. We’ll look at two main times: when your car needs repairs and when you need roadside help. Both show why having good accident coverage is important.

During Collision Repairs

If your car gets damaged in an accident, you might need a new ride. Rental reimbursement helps a lot here. It lets you rent a car while yours is fixed. This makes life easier and keeps your day running smoothly.

Roadside Assistance Scenarios

Accidents or car troubles are unexpected. But, having rental car coverage helps a lot. If your car can’t be used, this coverage might cover a rental car. This ensures you have a reliable car until yours is fixed.

Does Your Personal Auto Insurance Cover Rentals?

When we need to rent a car, knowing if our insurance covers it is key. We should check our policies to see what’s included for rentals. This helps us avoid surprise costs for repairs or other issues.

Checking Your Policy

To see if our insurance covers rental cars, we need to look at our policy. Important things to find include:

- Any mention of car rental insurance coverage within our coverage or endorsements.

- Details on rental reimbursement, which can help with rental costs during repairs.

- Limitations related to how long coverage lasts while using a rental car.

What to Look For

When we look at our insurance policy, we should watch for certain things:

- Specific clauses that show if rental vehicles are covered.

- The types of expenses that may be covered, like liability and collision.

- Limits on coverage amounts, which affect how much we have to pay if there’s an accident.

Rental Car Coverage in Credit Card Benefits

Many credit cards offer great insurance for rental cars. These credit card benefits can help with costs if there’s an accident or damage. It’s key to know what they cover and what they don’t.

Benefits of Using a Credit Card

Using a credit card for a rental has many perks:

- No extra fees for damages to the rental car.

- Protection against theft, including accident coverage.

- An easy claims process through the credit card company.

Limitations of Credit Card Coverage

But, there are some limits to credit card rental coverage:

- Some cars, like luxury or specialty ones, might not be covered.

- Certain places might not be covered by the insurance.

- You must pay the whole rental with the credit card to get benefits.

Always check our credit card’s rules before renting. This way, we know what rental reimbursement and coverage we can get.

Understanding State Laws on Rental Car Coverage

State laws can change how car rental insurance works. Each state has its own rules. Knowing these rules helps us stay safe and make smart choices.

Variances in State Regulations

States have different laws about rental car insurance. This can make things confusing. We need to know:

- The minimum insurance needed in our state.

- Any extra insurance options from rental companies.

- How these laws affect our personal safety when renting a car.

Implications for Drivers

Knowing state laws about rental insurance is very important. Drivers might face:

- Higher costs if an accident happens because of too little coverage.

- Uncertainty about which insurance to use when renting a car.

- The danger of legal trouble for not following state insurance rules.

Our Experience with Rental Car Insurance

At Miracle Body and Paint, we’ve learned a lot about car rental insurance. Many people get confused about how their insurance works. They wonder about accident coverage, for example.

We’ve talked to many customers. They ask us questions about insurance. We share what we’ve learned from these talks.

Common Questions We Encounter

Customers often ask us:

- What does car rental insurance coverage typically include?

- Will my personal insurance cover a rental vehicle during repairs?

- How does accident coverage work if I am involved in a crash while driving a rental car?

They want to know they’re protected when they rent a car. Talking to their insurance company helps them make good choices.

Lessons Learned from Customers

Good communication with insurance companies is key. Customers tell us:

- Checking policy details early can avoid problems later.

- It’s important to ask about accident coverage before renting.

- Guides from rental companies can help clarify things.

We use what we’ve learned to help our clients. This way, they have a better rental experience.

Choosing the Right Rental Car Insurance Plan

Finding the right rental car insurance can be hard. We want to make it easier for you. There are many choices, so think about what you need, what’s available, and how much you can spend. Knowing about car rental insurance and rental reimbursement can make your temporary car ride better.

Factors to Consider

When picking rental car insurance, think about these important things:

- Specific Needs: Think about how often you rent cars and what coverage you might need.

- Coverage Options: Look at different policies and what they cover, like damage and accidents.

- Budget Constraints: Decide how much you can spend, but don’t forget to get the coverage you need.

Tips for Saving on Rental Car Coverage

Here are ways to save money on rental car insurance without losing out on important coverage:

- Compare prices from different companies to find the best deal.

- See if your car insurance already covers rental cars.

- Think about raising your deductible to lower your premium.

- Ask about discounts for extra drivers or combining policies.

The Process of Claiming Rental Car Coverage

Claiming rental car insurance can seem hard. We want to make it easier. We’ll tell you the main steps and what documents you need. Knowing this helps you get the coverage you need quickly.

Steps to File a Claim

- Tell your insurance about the accident right away.

- Get the rental agreement and details of the accident.

- Fill out the claim form from your insurer.

- Send in your claim and any extra documents, like police reports or damage photos.

- Check with your insurance to see how your claim is doing.

Important Documentation Needed

Having the right documents makes claiming easier. Keep these ready:

- The rental car agreement.

- A copy of the accident report.

- Photos of any damage to the rental car.

- Your driver’s license and insurance policy info.

How Miracle Body and Paint Can Assist You

At Miracle Body and Paint, we’re all about top-notch collision repair. We know accidents can be stressful. So, we work hard to make fixing your car easy.

We team up with insurance companies to cover you fully. This way, you can relax while we fix your car.

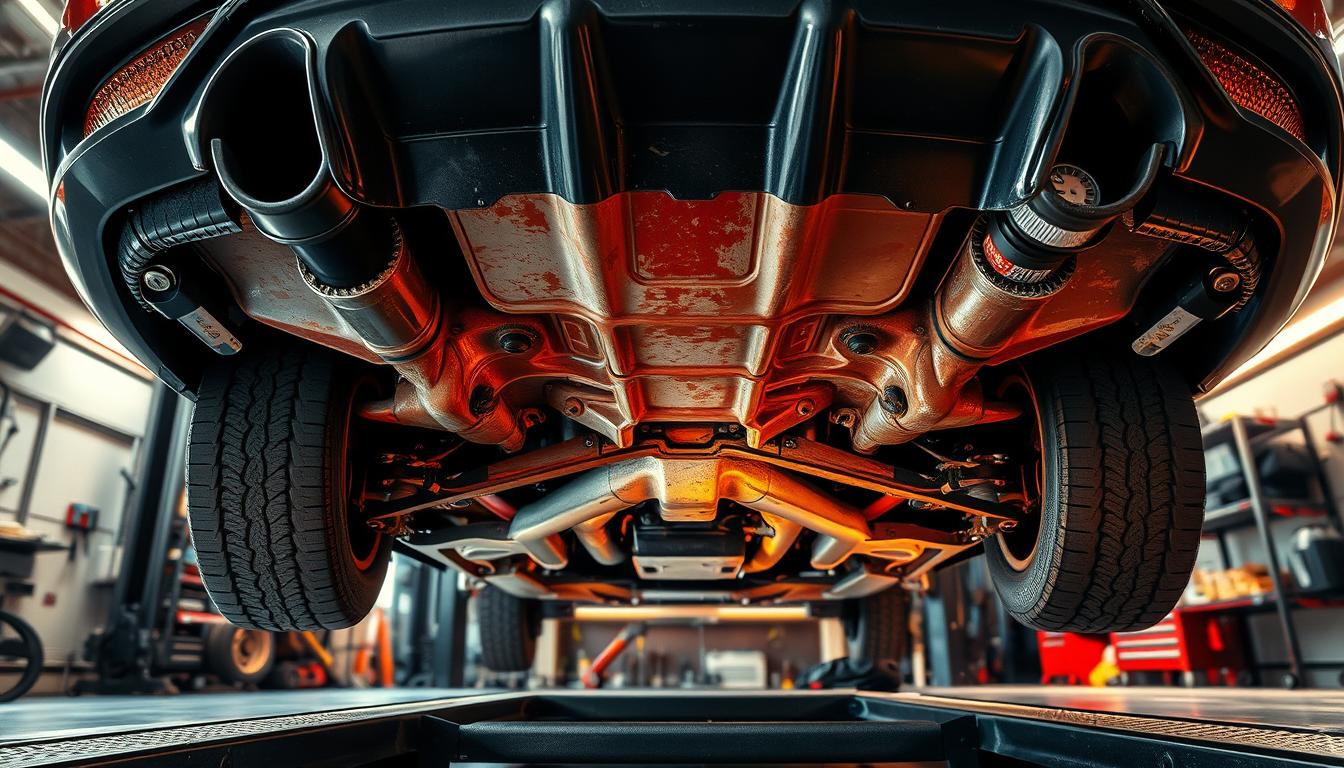

Collision Repair Services We Offer

We do a lot to fix your car, including:

- Frame straightening

- Paintless dent repair

- Auto body repair

- Refinishing and painting

- Detailing and cleanup services

Our techs use the latest tools to fix your car right. We aim to make it look new again. So, you can drive safely and worry-free.

Our Expertise with Insurance Claims

Dealing with car rental insurance can be tough after an accident. Our team knows insurance claims inside out. We’re here to help you with:

- Understanding your accident coverage options

- Filing claims accurately and promptly

- Communicating with your insurance provider

- Arranging for rental car coverage if needed

We take care of the insurance stuff. This lets you focus on getting your car fixed.

Why Choose Us for Your Collision Repair Needs?

We are proud of our top-notch collision repair work. Our team knows how to fix your car right. We make sure you’re happy with our service.

Our Commitment to Quality

We use the newest tools and methods to fix your car. We pay close attention to every detail. This shows our commitment to quality.

Customer Testimonials

We love hearing what our customers say. It helps us get better. Here’s what some happy customers said:

- “The team did an incredible job with my car. I felt like I was treated like family!”

- “Excellent service! They made handling my car rental insurance coverage a breeze.”

- “I highly recommend them for any collision repair needs. Truly professional!”

Get in Touch with Miracle Body and Paint Today!

Dealing with car repairs and insurance can be tough. That’s why we’re here to help. Our team is ready to answer your questions and make scheduling easy.

Locations and Contact Information

Find us at 6217 Grissom Rd. or 8026 Webbles Dr. in San Antonio. Our staff is ready to help with repairs or insurance. Just call us to talk about your needs.

Schedule Your Repair with Us!

Booking your repair is simple. We focus on making your experience great. Contact us today to fix your car and get back on the road safely!